On 17 March 2025, NERSA quietly approved Eskom’s Retail Tariff Plan. While most headlines focused on the news that Eskom’s requested 36% increase was cut down to 12.74%, the complex tariff restructuring that accompanied the announcement received far less attention.

Why restructure?

The changes are grounded in Eskom’s 2024 cost-of-supply study which highlighted how today’s network and generation costs are no longer aligned with legacy pricing models.

Over the last few years, the country’s electricity supply landscape has changed considerably, including the rise of embedded generation, private power producers and wheeling arrangements.

The restructuring is also partly due to Eskom’s unbundling into three separate service units, namely Generation, Transmission and Distribution, which necessitates more accurate cost allocation.

In the past, a “blanket approach” worked to blend generation and network charges all in one vertically integrated pot, as that was the way Eskom operated. But with the advent of more private generation, reliance on the grid for wheeling or a secondary source of supply makes this model unworkable. Hence, the more accurate and fair unbundling of generation and network fees.

The exercise, in a way, was long overdue anyway. And Eskom is adamant that the restructuring is not intended to increase revenue, but rather to ensure more equitable and transparent cost recovery in line with modern supply dynamics.

Key changes in the 2025/26 restructure

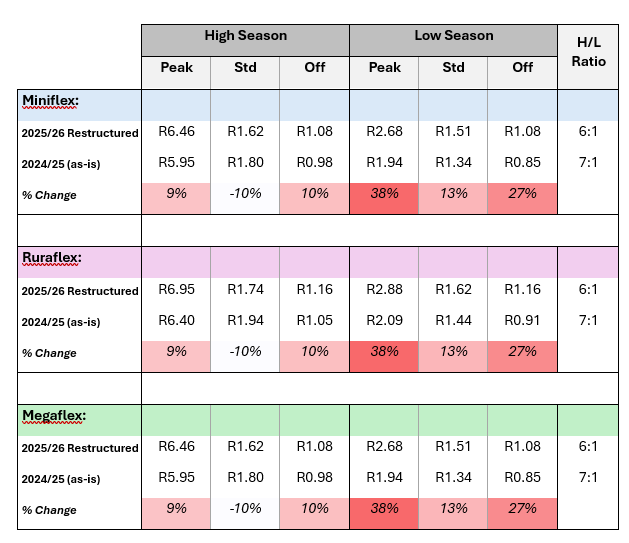

Updated time-of-use (TOU) schedules that split energy charges into Peak, Standard and Off-peak rates:

- Morning peaks shrink to 2 hours (from 3)

- Evening peaks extend to 3 hours (from 2) on weekdays.

- Sunday evenings shifted from Off-peak to Standard for 2 (previously all off-peak).

Revised high/low season ratios, reducing the current ratio of 1:8 for the summer (low-demand season), Off-peak rate to the winter (high-demand season), Peak rate to a 1:6 ratio and adjustment of other rates accordingly.

Unbundling of energy charges and adding Generation Capacity Charge and Legacy Energy Charge components. The former is prescribed to be phased in at 20% in year 1 and 30% in years 2 and 3 to lessen the impact on customers.

Unbundling and adjustment of other network and service charges. Part of this is also the amendment of cross-subsidising between tariff types.

Understanding the Generation & Legacy charges

The Generation Capacity Charge is a fixed monthly charge based on your supply capacity, regardless of energy use. The motivation behind this is to “keep dispatchable power supply capacity in reserve” for users with intermittent and variable load factors.

In simpler terms, it means that Eskom will need to keep a power station ready for when your embedded solar generation is not adequate and requires the grid and backup. Low load factor users, like seasonal agri-processors, are especially vulnerable to this cost.

The Legacy Energy Charge recovers costs from legacy power purchase contracts entered into under the first rounds of the Independent Power Producer (IPPs) programmes, which were higher than current generation costs. This can be viewed as a sort of premium on renewable energy provided by Eskom. High kWh users are most impacted. LEC can represent 7–10% of annual electricity spend.

What does this mean for you?

Our team at Energy Partners ran an in-depth analysis using Eskom’s tariff comparison tool, assessing the impact across a wide range of sectors – from agri-processing to retail, hospitals, and fuel forecourts.

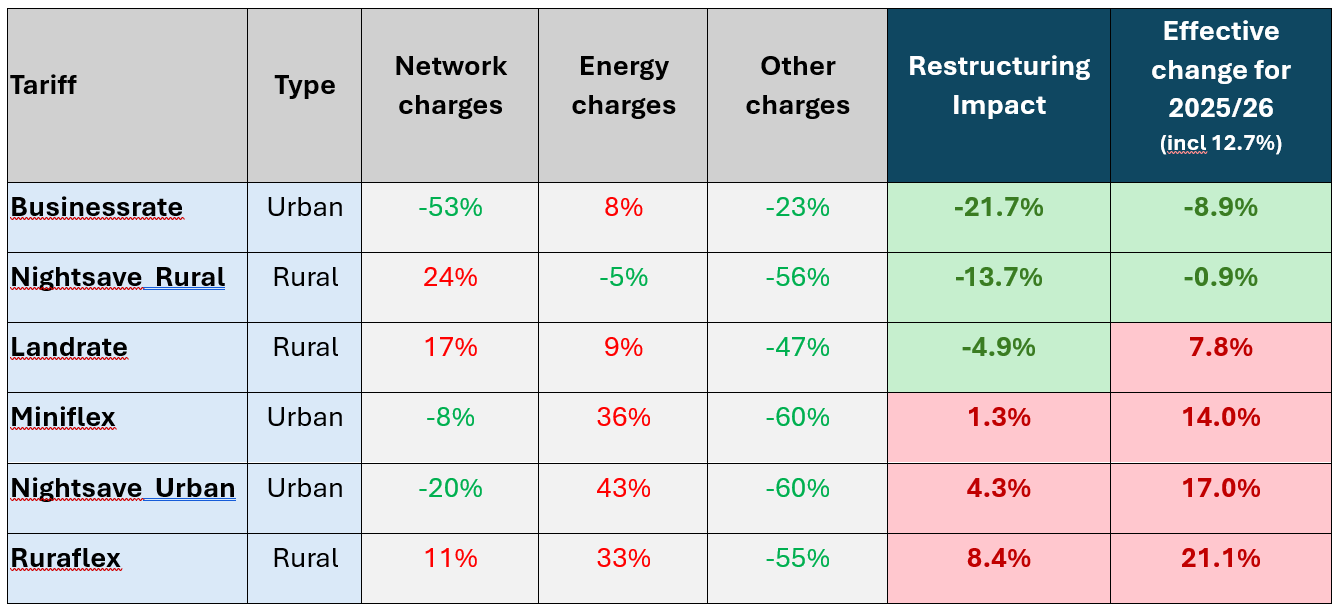

The results showed vastly differing outcomes, with some users potentially experiencing increases way above the 12.74% increase announced for this year; others may even see decreases.

The analysis also looked at factors such as average monthly consumption, demand, notified capacity and load factor to gain a better understanding of the driving factors on the restructured tariffs.

Insights

- Rural users are hit hardest, particularly on tariffs like Ruraflex and Landrate. A key contributor to this is increased network charges. This is presumably because of the typically remote locations and low density of these users, meaning overhead costs are spread between fewer customers. Previously, this tariff category was also subsidised to a large extent through urban tariffs. Such cross-subsidising has been addressed to take a more “user pays” approach. The highest hit tariff is Ruraflex with the restructuring adding a massive 8.4% on top of the normal annual increase, meaning these customers will experience an increase of 21% this year.

- The second-highest tariff impacted is Nightsave Urban, commonly used by large users such as industries and large retailers in urban areas. The restructuring will have an average impact of a 4.3% increase, giving it an effective increase of around 17% for this year, much more than the anticipated 12.74% that was announced.

- Miniflex, also a commonly used urban tariff by large power users, is the only tariff relatively in line with the 12.74, although it will also experience an additional increase of 1.3%.

- Urban Businessrate users, typically small commercial clients, will benefit most.

- Low load factor users (such as agri-processing) are highly affected by the Generation Capacity Charge. This is because it’s a fixed charge that applies monthly regardless of how much electricity is actually used. Customers with high notified demands (in the order of 1 MVA or more) are also highly affected by this new component. In this case, the sheer size of the connection is the main contributing variable. In both cases, keeping notified demand capacity to the utmost minimum will become an important aspect to manage. Unused capacity will simply incur more fixed costs each and every month.

- High energy consumption users (kWh) are more likely to be affected by the Legacy Energy Charge as a driver of the increases. The analysis found that the Generation Capacity Charge can range from 0.5% to 3% of total annual cost, depending on load factor and notified demand. The Legacy Energy Charge typically makes up between 7% to 10% of the total annual cost, depending on kWh consumption.

- The swapping around of the TOU periods does not seem to have a significant impact. For high load factor or constant load users that operate 24/7, it makes little difference whether the peak is longer in the morning or evening. For retailers or offices that have a typical 8am-5pm profile, it’s beneficial as the more expensive evening Peak period now falls outside their high-load times of the day. The morning peak, which does fall within operating hours, is now shorter, meaning more of the less expensive Standard rates apply.

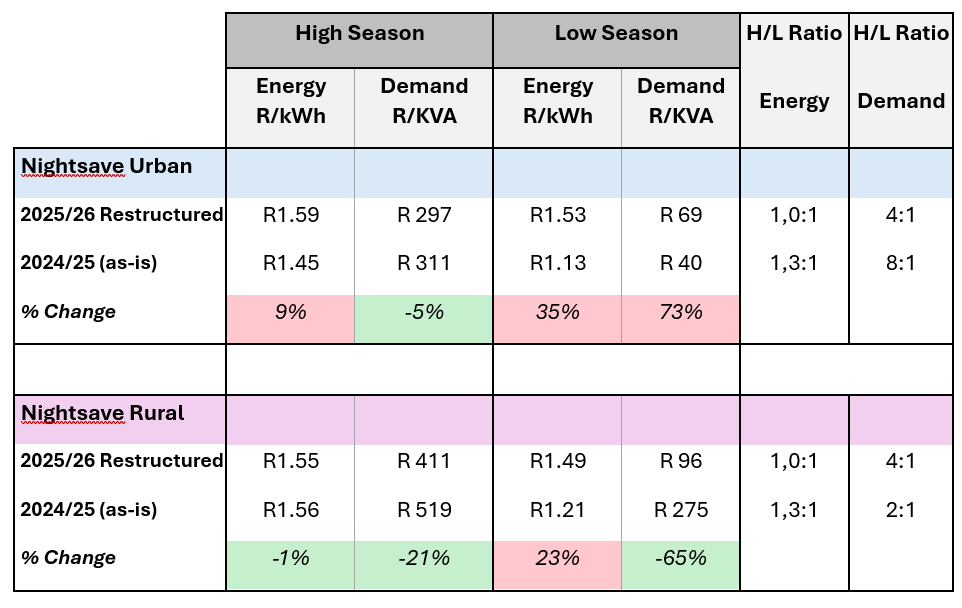

- The Nightsave Rural tariff seems to be an anomaly, showing that this particular tariff can decrease by around 13.7% on average, making it 0.9% less expensive compared to last year. Closer inspection reveals that Eskom applied a significant decrease on the low season Demand Charges in this tariff. As this tariff is heavily weighted on demand charges, it makes sense that this tariff is seeing such as significant decrease in the large power user category.

The table below shows the average energy and demand tariffs applicable to Nightsave Urban and Rural tariffs. It’s clear that the balance between winter and summer rates has been adjusted.

An interesting observation is that the low-season tariffs have been lifted instead of lowering the more expensive high-season tariffs. What this means is that higher rates now apply for more time during the year.

- Small power users on Businessrate and Landrate tariffs are set to benefit greatly from the restructuring. Businessrate customers in Energy Partners’ survey can experience an effective decrease of up to 8.9% compared to 2024/25. But obvious again is the disadvantage that rural customers face. The Landrate tariff, which is the equivalent of the urban Businessrate, and is commonly used by farmers and rural users, will decrease by only 4% as a result of the restructuring (compared to -21% for Businessrate), leading again to the conclusion that higher network charges and a smaller customer base is playing a role.

- The introduction of the Generation Capacity Charge also affects the Miniflex and Ruraflex tariffs negatively. Previously, these two tariff categories were not as heavily weighted in fixed network costs, which is no longer the case.

Final thoughts

The 2025/26 tariff restructuring introduces complexity that many businesses may not have anticipated, especially those focused only on the modest 12.74% average increase. As shown, the restructuring will affect each type of user and tariff profile very differently.

For C&I clients, this is a clear signal: the old ways of managing electricity bills no longer apply. Now is the time for proactive energy cost modelling, load factor optimisation, a strategic review of notified capacity, and energy efficiency and demand response initiatives.

At Energy Partners, we’re already working with clients to navigate these changes, optimise consumption and reduce exposure to rising fixed charges.

Let’s talk about your tariff risk and how to respond. Reach out to our team at sustainability@energypartners.co.za